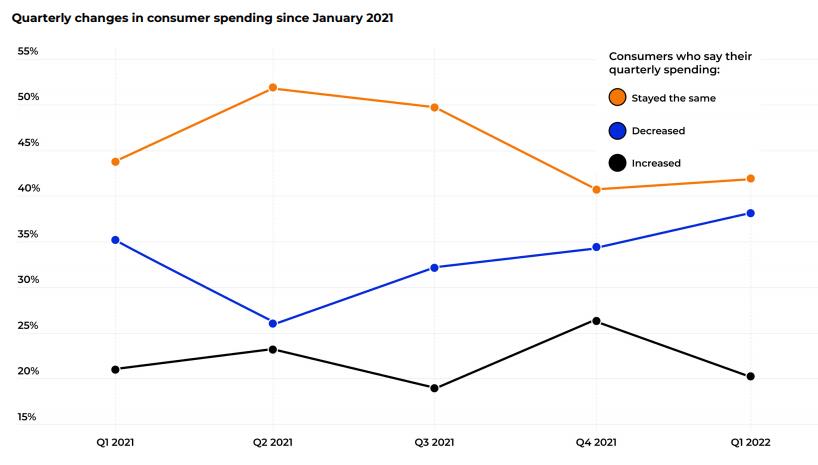

Consumers Cut Spending in 2022

How inflation is affecting consumer spending online and in-store, the persistence of the homebody economy during the COVID-19 pandemic?

Consumers are reducing their spending, with an eye on inflation and savings goals.

• 72% of consumers say rising inflation has affected their spending on consumer goods, and 70% are making fewer “fun” or impulse purchases.

• 38% of consumers say their overall spending will decrease in Q1, and 34% say their online spending will decrease — the highest reported figures on decreased consumer spending in at least one year.

• 52% of consumers are currently saving up for a big purchase or expense, including vehicles, vacations, business ventures, and real estate.

U.S. inflation climbed to 7.5% over the past year, breaking a decades-old record in January of 2022. In reaction to inflation and elevated prices on a range of goods including gas and food, many consumers are reducing their spending in Q1. In fact, more consumers anticipate spending less money this quarter than they have in any quarter in the past year. From inflation to ambitious savings goals, consumers have important reasons for reducing their spending in 2022.

Post time: Apr-29-2022